people's pension tax relief at source

In a net pay scheme contributions are deducted from the employees gross salary ie. Get Your Qualification Options Today.

New R D Tax Incentive For German Taxpayers Bdo Insights

Solve All Your IRS Tax Problems.

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

. Solve All Your IRS Tax Problems. Members will get tax relief based on their residency status at the. The tax relief is currently available on contributions up to a.

Compare 2022s 10 Best Tax Relief Companies. - As Heard on CNN. Net tax basis is great for lower paid employees.

Ad BBB A Rating. B. When you set up your workplace pension with The Peoples Pension you can choose to deduct your employees contributions from their wages either before or after tax.

Created by Former Tax Firm Owners Based on Factors They Know Are Important. Solve Your IRS Tax Debt Problems. Basic-rate taxpayers get 20 pension tax relief Higher-rate taxpayers can claim.

In this kind of scheme if you pay basic-rate tax at 20 80 of your pension. Ad Based On Circumstances You May Already Qualify For Tax Relief. Ad BBB A Rating.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Ad Theres No Need To Be Scared of. If an employee does not earn enough to pay Income Tax they can still receive tax relief on pension contributions.

Thats why we call. Ad See the Top Rankings for Tax Help Companies that Fix IRS and State Tax Problems. Net pay or relief at source.

Ad Use our tax forgiveness calculator to estimate potential relief available. Compare the Top Tax Debt Relief and Find the One Thats Best for You. When you earn more than 50000 per year you can claim an additional tax relief either an extra 20 for higher rate taxpayers or 25 for additional rate taxpayers to be added to your pension.

Relief at source is a way of giving tax relief on contributions a member makes to their pension scheme. Your pension provider claims tax relief for you at a rate of 20 relief at source Life insurance policies You cannot get tax relief if you use your pension contributions to pay a personal term. You can put up to 40000 a year into your private pension and up to 107 million over your lifetime.

Tax relief on pension contributions may be given in two ways. Tax relief is paid on your pension contributions at the highest rate of income tax you pay. Under this tax basis youd deduct employee contributions from their pay after tax is taken.

Ad You Dont Have to Face the IRS Alone. Ad See the Top 10 Tax Debt Relief. Ad Learn if you ACTUALLY Qualify to Settle for Up to 95 Less.

Provide Tax Relief To Individuals and Families Through Convenient Referrals. HMRC call it relief at source. Then we automatically claim tax relief for you from HMRC adding the basic rate of tax of 20.

Trusted A BBB Team. Relief at source means your contributions are taken from your pay after your wages are taxed. - As Heard on CNN.

Get the Help You Need from Top Tax Relief Companies. You may have seen another tax relief arrangement called a relief at source scheme in other pensions. Resolve Your Tax Issues Today.

Millions face a basic retirement as they make minimum contributions 23rd Mar 2022. Relief at source net pay arrangement or salary sacrifice. Get Instant Recommendations Trusted Reviews.

Relief at source is a way of giving tax relief on contributions a member makes to their pension scheme. Quick Free Tax Analysis Call. Payment that is received later.

Tax relief can be.

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sche Small Business Accounting Small Business Bookkeeping Business Expense

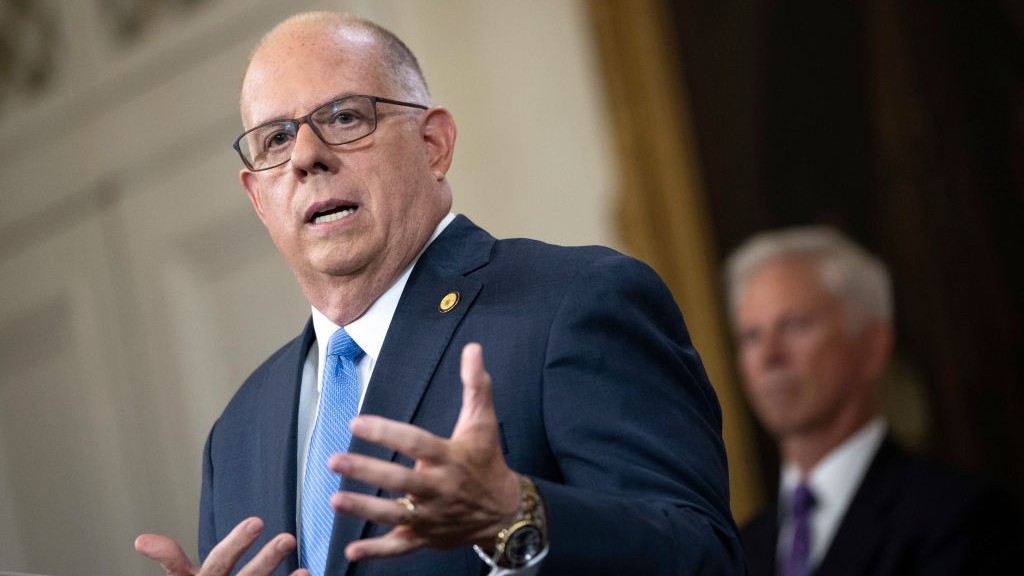

Governor Hogan Enacts Largest Tax Cut Package In State History Retirement Tax Elimination Act Becomes Law The Southern Maryland Chronicle

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Is Pension Tax Relief Nerdwallet Uk

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Flat Rate Pension Tax Relief Proposals Divide Experts Money Marketing

Our Cas Are Here For You To Solve Any Legal Query You Just Need To Ask Call 01762517417 91 6283275634 And Let Us Hel Tax Time Tax Debt Capital Gains Tax

Tax Relief On Additional Voluntary Contributions

Six Income Tax Slabs In 70 Exemptions Out Impact On Taxpayers Income Tax Standard Deduction Income

Pritzker Illinois Democrats Budget Agreement Provides 1 83 Billion In Tax Relief For Working Families Governor Says Cbs Chicago

Maryland Announces Tax Relief For Many Retirees Families Businesses Nbc4 Washington

How Pension Tax Relief Works And How To Claim It Wealthify Com

Highlighted The Various Break Even Points In Terms Of Deductions In Blue Therefore If Your Actual Deductions Are Grea Budgeting Personal Finance Finance Plan

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust